What are Muscular Portfolios?

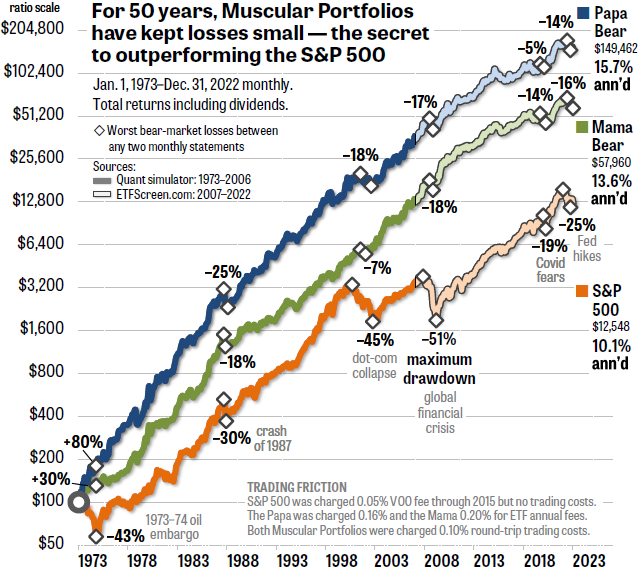

A Muscular Portfolio is a mechanical-investing formula designed by a financial expert, using a Momentum Rule on nine or more exchange-traded funds (ETFs), fully disclosed and free of charge. The book Muscular Portfolios (BenBella Books, 2018) reveals how any individual investor can keep losses below 20% to 25% — even when the S&P 500 is crashing 50% or more.

Keeping your losses small is the secret to superior returns over complete bear-bull market cycles. In the US, stocks fall into a bear market (a loss of more than 20%) or a crash (a loss of more than 30%) approximately every 10 years.

How do you know these portfolios beat the market?

How do you know these portfolios beat the market?

Between 1973 and 2015, the returns shown in the book were projected by the Quant simulator, a software program by investment adviser Mebane Faber that uses the historical prices of asset classes, such as stocks and bonds.

Beginning in January 2007 and continuing to this day, the independent data-analysis firm ETFScreen has used the prices of actual ETFs to calculate the returns.

The graph above unites those two streams of data into the 50-year returns for each portfolio. The results show that the Papa Bear and the Mama Bear have outperformed the S&P 500 (including dividends) for the past five decades in each bear-bull market cycle — the shortest period that is meaningful. For details, see Newsletter #50.

The two portfolios’ financial returns — and the specific ETFs they selected each month since Dec. 31, 2006 — are updated a few hours after the close of every market day at ETFScreen’s Mama Bear performance page and Papa Bear performance page.

What if we held BOTH the Mama and the Papa?

A study indicates that there are benefits to such a “blended” strategy. You’d have to commit the necessary time to hold six different ETFs each month rather than three. You would allocate half your money to the Mama, half to the Papa, and rebalance back to 50/50 on Dec. 31 of each year. In simulations back to 1973, this produced a return approximately halfway between the Papa’s gain and the Mama’s gain, but with the smaller losses that are typical of the Mama. It’s called the Power Couple Portfolio, because it’s ideal for two people. Couples can double-check that one person or the other is actually doing the trades each month. See Newsletter #30 and Newsletter #31.

How are Muscular Portfolios different from Lazy Portfolios?

Lazy Portfolios, which arose in the 1990s, never make any changes in the percentages they allocate to whatever funds they recommend. Because Lazy Portfolios can’t adapt to market conditions, they subjected investors to unacceptable losses of 36% to 49% in the 2007–2009 bear market, adjusted for dividends and inflation. (See Figure 5 of Newsletter #50.) Most people find those kinds of losses in their life savings to be intolerable.

Why is it important to keep portfolio losses low?

The new science of behavioral finance shows that most people have a “behavioral pain point.” After personal losses of more than 25%, many people start liquidating their stock positions near the lows of a bear market. These investors also miss out on the first few months or years of the subsequent bull market, when returns are the strongest. This hurts investors’ long-term performance. The pain can be avoided by making sure a portfolio is designed to never drop more than 20% to 25% in the first place. It’s easy to keep losses this low — while achieving excellent returns — with a Muscular Portfolio.

Are Muscular Portfolios active or passive investing?

Neither. Muscular Portfolios are examples of mechanical investing. This means following a computerized formula rather than making intellectual-emotional decisions, which fall prey to behavioral mistakes. Active investing is the practice of buying and selling securities based on one’s own opinions. Many studies have shown that this underperforms the market. Passive investing doesn’t permit any portfolio changes at all. This exposes investors to huge losses during bear markets and — even worse — passive portfolios seriously lag the S&P 500. See section 2 of Newsletter #50.

I live outside the US. Can I buy index funds that are in my currency?

Two StockCharts columns by Brian Livingson describe the process of finding matching funds in currencies other than the US dollar. Please see Column #1 and Column #2.

If this website and your columns are free, how do you make money?

Neither MuscularPortfolios.com nor the author, Brian Livingston, sell any financial products or services. The whole point is to teach you how to grow your savings without paying any fees to anyone. We make money solely from the sale of books, newsletters, seminars, and other educational information. Following a Muscular Portfolio doesn’t require any purchase at all — you can use each plan without paying a penny.

How can I find out more?

The Muscular Portfolios book is available at Amazon, Barnes & Noble, and all other booksellers. A free summary of the entire book is available on a StockCharts.com page.

No comments